A case for consuming more beer

Shobhan Roy

It is estimated that of the top 30 global beer markets, India has the lowest affordability of beer relative to average GDP. With tax rates ranging from about 50 to 75% across States, beer has the lowest affordability in India.

Beer with rational taxes and liberal positioning can help the States ween people away from hard liquor and achieve a responsible drinking culture. It is time beer is given its due and delinked from hard liquor in terms of perception, taxation, availability and distribution.

India is one of the most promising Alcoholic beverage consuming markets in the world, but when one checks the beer statistics, the story is different. Beer per capita consumption hovers around 4 litres per capita against 38 litres per capita in China. The per capita consumption of Spirits is 11.4L per capita compares favourably globally (WHO, 2014). With a rich demographic profile of which 54% of the population is younger than 25 years and 1.74 million people enter the legal drinking age every year, coupled with rising income levels (a growing middle class), rapid urbanization and societal taboos disappearing, there has been an evolution in the perception of alcohol. However, restrictive regulations, regressive taxation are curbing the consumption and growth of low alcoholic products like beer and promoting hard liquor.

| STATE | SPIRITS DUTY PER A/A PER LITRE INR | BEER DUTY A/A LITRE INR |

| A Northern State | 360 | 872 |

| A Western State | 52.57 Plus MRP % | 75 Plus MRP% |

| A Southern State | 135 | 684 |

A/A Absolute Alcohol

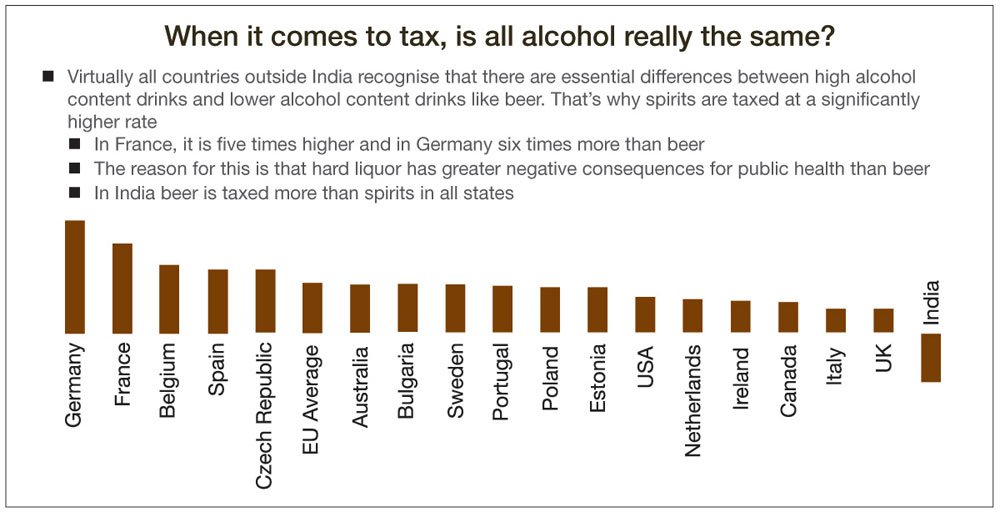

All countries recognise that there are essential differences between high alcohol content drinks and lower alcohol content drinks like beer. The Indian alcohol industry is characterized by a paradoxical phenomenon, an opposite pattern is observed. Based on alcoholic content, spirits are taxed at rates much lower than Beer on alcohol content basis making hard spirits affordable. Ironically, this is pushing youth to hard spirits due to net lower prices!!

It is estimated that of the top 30 global beer markets, India has the lowest affordability of beer relative to average GDP. With tax rates ranging from about 50 to 75% across States, beer has the lowest affordability in India. Globally, beer forms 80% of the alcobev sector. In India Beer is only 35% when compared on volume basis. On actual factual basis, beer alcohol is only 7% of the total alcohol consumed in the country in absolute terms!!

ALCOBEV

GLOBAL V/S INDIA

Going Forward, the States need to differentiate Distilled Alcoholic beverages (high strength alcohol products) from Fermented alcoholic beverages like Beer and Wine which must be encouraged Neither the Constitution nor the State laws segregate/differentiate between categories of alcohol products viz. beer, wine and spirits; which have varying degrees of alcohol and clubbed as intoxicating liquors. The States therefore need to make a beginning to differentiate low alcoholic beverages in terms of taxes, sales, availability etc. especially for the overall wellbeing of society.

Going Forward, the States need to differentiate Distilled Alcoholic beverages (high strength alcohol products) from Fermented alcoholic beverages like Beer and Wine which must be encouraged Neither the Constitution nor the State laws segregate/differentiate between categories of alcohol products viz. beer, wine and spirits; which have varying degrees of alcohol and clubbed as intoxicating liquors. The States therefore need to make a beginning to differentiate low alcoholic beverages in terms of taxes, sales, availability etc. especially for the overall wellbeing of society.

- High incidence of Tax on Beer alcohol namely other spirituous products’ is driving our promising youth and others to hard spirits on affordability factor. Globally, beer consumption as seen from the chart below is around 80% of the alcobev sector. It is 35% in India!

- From the economic standpoint beer contributes significantly to State exchequer. In fact, even though the alcohol in Beer is 7% of the total alcohol consumed, it contributes 22% of the revenue on an average to the State’s kitty make. The production and sale of beer creates jobs in agriculture, breweries, pubs, bars, restaurants and the wider supply chain. Beer is essential for the tourism Industry. Foreigners treat beer as a refreshing beverage in their countries. The sector supports over a million jobs.

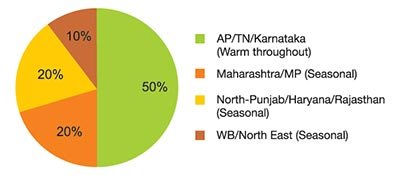

As per AIBA data, the major market for the beer is the southern States of Andhra Pradesh, Tamil Nadu, Karnataka, Kerala and Maharashtra. The reforms need to start here.

Spirits are taxed at a significantly higher rate all over the world mainly because hard liquor has greater negative consequences for public health than beer. Therefore, In France, it is five times higher and in Germany six times more than beer. Other BRICS nations like Brazil taxes 30% on beer, while China taxes at the rate of 15-18 per cent. In Russia, beer with less than 8.6% alcohol is taxed at 18 Roubles per litre, while spirits and beer above 9% alcohol are taxed at 500 Roubles.

Spirits are taxed at a significantly higher rate all over the world mainly because hard liquor has greater negative consequences for public health than beer. Therefore, In France, it is five times higher and in Germany six times more than beer. Other BRICS nations like Brazil taxes 30% on beer, while China taxes at the rate of 15-18 per cent. In Russia, beer with less than 8.6% alcohol is taxed at 18 Roubles per litre, while spirits and beer above 9% alcohol are taxed at 500 Roubles.

TREATMENT PROPOSED

In keeping with their political objective to show restrictive consumption, States raise its revenue targets, the category of Spirits (Country liquor included), Beer and Wines are clubbed as intoxicating drinks and are taxed on volumetric or price basis (Excise plus VAT/AED). Not differentiating that products like Beer have only 5-7% abv, Country liquor at 28.7% abv and Spirits at 42.8% abv. Thus, on absolute alcohol content basis beer gets taxed higher than all alcoholic beverages which reflects’ in high Beer prices when compared to hard spirits. This translates to high beer retail prices. In addition, the norms for buying selling consuming are the same as that for hard spirits!!

In fact, States should adopt policies to strike a balance between distilled spirits, products and low alcoholic fermented beverages like beer in terms of taxation.

- Beer: a low alcoholic beverage is a refreshing beverage and therefore needs to be treated differently from other intoxicating beverages.

- Tax uniformity: Uniformity in taxes across states on absolute alcohol content basis. Follow the policy of equivalence to start with. In India, it is the opposite, Beer alcohol is being taxed more than sprits at multiples 1.5 to 3.5 times. Therefore, to follow principle of Equivalence will be a welcome start.

- Deregulation of availability of beer: It is imperative to create better retail environment with the aim to entrench good beer selling practices and develop value-added structures such as better point of-sale promotions. There is a need to have separate beer only Outlets/Restaurants and rationalize the number of outlets to be commensurate with population. The states need to increase Shops and consumption points for beer.

- Let all new licenses be just beer outlets at reasonable license fees. It will have a sociological benefit. Kerala has implemented this policy pretty successfully i.e. only 3 stars and above can serve spirits. Otherwise all other hotels categories, pubs, restaurants can only serve Beer and wines. Tourists generally have beer only.

- Inclusion of Beer under Goods & Services Tax: There is no point in excluding beer from GST with 5% alcohol by volume. Beer has a tremendous impact on tourism industry as also in restaurants and bars turnover. Foreigners and tourists love their beers. The states can start in a few months’ time once GST implementation is stabilised to recommend the case for beer in GST to the Centre.

- In-spite of the indiscriminate taxation on beer, the revenue from this category is around 20% of the States Alcohol revenue. With liberalisation and reasonable taxation, the increased volumes will generate more revenue and a hospitable drinking culture. It is a direct agricultural product requiring less water and benefits the farmers and generates employment all round.

Beer with rational taxes and liberal positioning can help the States wean people away from hard liquor and achieve a responsible drinking culture. Its time, beer should be given a break and this is possible only if it is delinked from hard liquor in terms of perception, taxation, availability and distribution. We all agree that all alcoholic products have inherent risks when it comes to excessive consumption, yet it is widely recognised that the consequences of over consumption are far greater from hard liquor products.

The views and opinions presented expressed here are solely those of the author in his private and personal capacity.